In banking, business, or family, developing trust and patience takes two (or more) people. For our customers, they need your trust, and you need theirs. Trust is not an easy thing. But it is one of the best things we do as a community bank for our customers and ourselves.

Author: Powell Valley National Bank

Stacy Jenkins Joins PVB

Jonesville, Virginia– PVB is pleased to announce Stacy Jenkins has joined the Bank as Assistant Vice President and Commercial Loan Processor. Jenkins joins PVB with 23 years of banking and customer service experience. Throughout her banking career, she has fulfilled multiple roles within the industry, serving the Wise County and City of Norton area. “Stacy… Read more »

PVB Promotes Tenesia Berry

Jonesville, VA – PVB is pleased to announce the promotion of Tenesia Berry to Assistant Vice President. Tenesia joined our treasury management team in April 2024 serving the role of our Treasury Management Specialist. She came to PVB with fourteen years of banking and customer service experience. “Tenesia’s efforts have been monumental for our treasury… Read more »

Letters From Leton: Did You Notice Something?

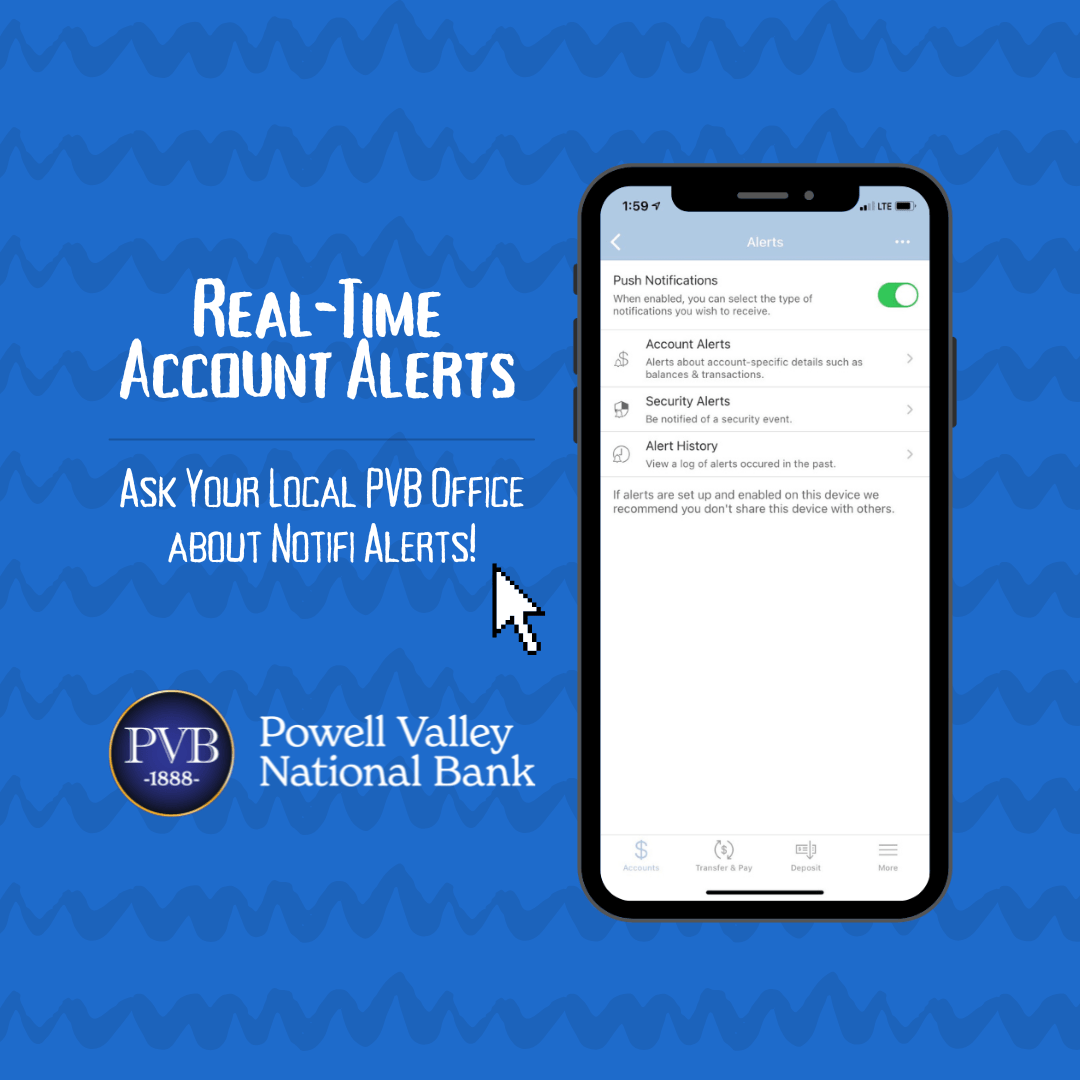

For those of us who are of a certain age or certain inclination, using technology and its benefits are second nature. To others (seniors, small businesses), Technology can be intimidating or, at a minimum, something that they just don’t have time to learn. It is PVB’s goal to take our customer support to another level and be a “tech” buddy to customers who lack knowledge or confidence.

Letters From Leton: Good Things Come in Threes (and Maybe More)!

It’s that time of year. High School and College Graduations abound, taxing our schedules. This spring, we have several of our own “PVB” graduates whom we want to celebrate.

Letters From Leton: The (not so) Great Gatsby!

Most folks are aware of The Great Gatsby, a 1925 novel by F. Scott Fitzgerald, known in some circles as the “Great American Novel.” But it didn’t start out that way.

Tips to Protect Consumers During a Rise in Phishing Scams

In light of the recent rise in phishing scams, and specifically text scams, the Virginia Bankers Association (VBA) urges all bank customers to be vigilant in detecting these scams. Every day, thousands of people fall for fraudulent emails, texts, and calls from scammers pretending to be with a bank. These are commonly referred to as phishing… Read more »

Letters From Leton: A Complete Unknown

Over the weekend, we watched the movie “A Complete Unknown”, a movie about Bob Dylan and his blossoming career. There are lots of things one could take from the movie: His relationships with Johnny Cash, Pete Seeger, Joan Baez, Woody Guthrie and other noted musicians. His difficulty relating to others, including his girlfriend, made… Read more »

PVB Promotes Ted Fields

Jonesville, Virginia– PVB is pleased to announce the promotion of Ted Fields to Chief Banking Officer and Head of Deposit Sales and Operations. “I am excited to announce this promotion, as Ted’s profound leadership and expertise have been instrumental in driving our success and efforts in the Kingsport and greater Tri-Cities area,” said Leton L.… Read more »

2025 Top Virginia Employer for Interns

Jonesville, Virginia–Powell Valley National Bank (PVB, Bank) was recognized as a 2025 Top Virginia Employer for Interns. The award, administered by the Virginia Talent + Opportunity Partnership (V-TOP) in collaboration with the State Council of Higher Education for Virginia, Virginia Chamber of Commerce Foundation and the Virginia Business Higher Education Council, recognizes organizations for their… Read more »